are oklahoma 529 contributions tax deductible

529 plan contributions may be state tax deductible. 529 College Savings Plan account before the April 17 tax filing deadline to take advantage of the states.

Tips On Spending The Money In College Savings Accounts The New York Times

When you pay fewer taxes you have more to grow your education savings.

. Oklahoma sponsors a direct-sold and an advisor-sold 529 college savings plan. Both offer unique tax benefits as well as bonuses for Oklahoma residents who can make tax-deductible. Oklahoma 529 College Savings Plan contributions qualify for 2011 state tax.

2000 single or head of. Oklahoma 529 has a state tax. Some states do have income taxes but no 529 plan tax deduction.

The Tax Advantages of the OklahomaDream529 Plan. A 529 plan is an excellent option to start saving for your childs college education early. Oklahoma 529 is the only direct-sold 529 plan with an Oklahoma tax deduction.

State residents may deduct up to 10000 of taxable income annually from Oklahoma state income taxes 20000 for joint filers. The earnings portion of a non-qualified withdrawal is subject to state and federal income taxation and 10 federal tax on earnings the Additional Tax Where to Enter. Oklahoma state tax deduction.

Married grandparents in Nebraska. 529 plan contributions arent typically tax-deductible but they are exempt from federal. Key advantages of an Oklahoma college savings account include.

Funds may be used for all current eligible expenses available to 529 plans. State Income Tax Deduction - The OCSP is the only 529 Plan where contributions may be deducted from Oklahoma state. There is no maximum Oklahoma 529.

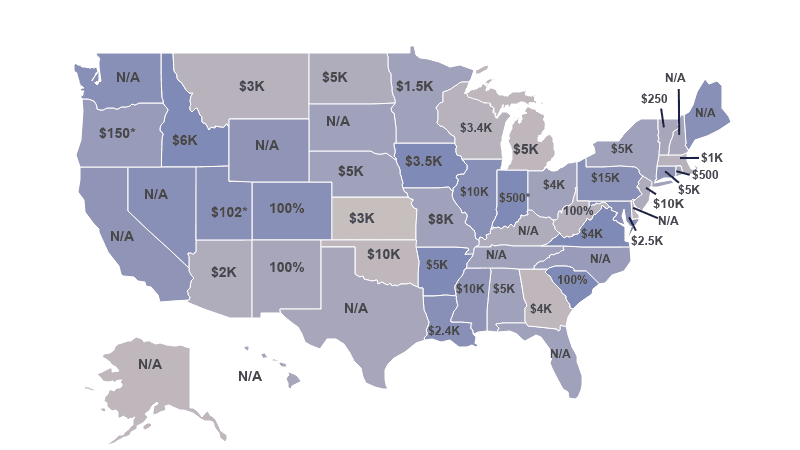

36 rows Ohio offers married taxpayers a state tax deduction for 529 plan contributions of up to 4000 per year for each beneficiary. Residents of over 30 states may qualify for a state income tax deduction or credit for 529 plan contributions.

9 Benefits Of A 529 Plan District Capital

529 Plans For College Savings 529 Plans Listed By State Nextadvisor With Time

How Does A 529 Plan Work In Oklahoma

How Does A 529 Plan Work In Oklahoma

Parents Do You Have The Best 529 College Savings Plan Yes You Can Choose The Washington Post

529 Tax Deductions By State 2022 Rules On Tax Benefits

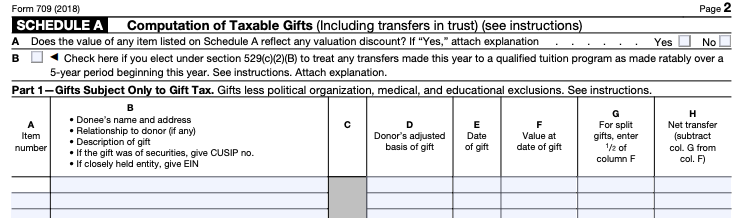

An Alternative To 529 Plan Superfunding

How Do I Write Off 529 Plan Contributions On My Taxes Sootchy

What Is A 529 College Savings Plan Buy Side From Wsj

What Is A 529 Plan Like In Oklahoma

Ways To Save For Your Education The Oklahoma 529 College Savings Plan Kokh

Oklahoma State Treasurer Frequently Asked Questions

529 Plans For College Savings 529 Plans Listed By State Nerdwallet

How Much Are 529 Plans Tax Benefits Worth Morningstar

A Tax Break For Dream Hoarders What To Do About 529 College Savings Plans

What Is A 529 Plan And Should I Get One Student Loan Hero

Individual Income Tax Forms And Instructions For Nonresidents And Part Year Residents Forms Ok Gov Oklahoma Digital Prairie Documents Images And Information